What’s your company worth?

If you’re like a lot of entrepreneurs, you assume the value of your company will be determined by your industry and its size. While size matters, there are actually seven other factors that impact the value of your company more than your industry. In fact, after analyzing more then 30,000 businesses, The Value Builder System™ has discovered getting these seven factors right can lead to acquisition offers that are more than twice the industry average. Likewise, we have seen examples of companies getting less than half the industry average multiple because of a weakness in one or more of these seven areas. To see how your company scores, you can complete the Value Builder questionnaire and get Your Value Builder Score and a report on how you’re doing in each area.

What is Value Builder?

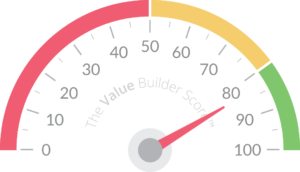

The Value Builder System™ is a statistically proven methodology designed to improve the value of a privately held business. At the core of the system is The Value Builder Score™, an evaluation system driven by an algorithm that evaluates a business on the eight core value drivers acquirers take into consideration when buying companies. The Value Builder Score™ gives a comprehensive assessment of the “Sellability” of your business, whether you want to sell next year or just to know that you’re building a valuable asset for the future.

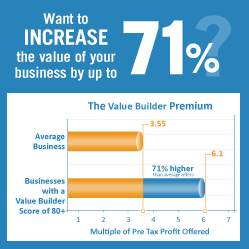

After analyzing more than 30,000+ businesses, analysts at The Value Builder System™ have discovered that companies with a Value Builder Score of 80+ received offers that are 71% higher than the average-scoring business.

The Value Builder System™ is available exclusively through an experienced and authorized group of advisors, known as Certified Value Builders™, located across the globe.

Get Your Value Builder Score and your tailored report on how you’re doing in each area.